Recently, Norberto Santana of the

Voice of OC reported that

LFC—a company that Tom Fuentes worked for (still does?) and that

contributed to John Williams’ PAPG reelection campaign—has been awarded a large contract to liquidate properties controlled by Williams’ office (see

Focus on Contract Between Auction House and Public Administrator).

We here at DtB have examined Fuentes’ ties with LFC before. What follows is from "

Trustee Fuentes' boss, Buffalo Bill Lange" (2006).

FUENTES' SPECIAL MAGNETISM:

checked out Trustee Fuentes’ bio on the district website. It informs us that he is "Senior Vice President of the LFC Group of Companies.”

So I looked up the LFC “group.” LFC is owned by one William Lange (the L is for "Lange"). The company arranges online auctions of real estate. Imagine that!

Apparently, LFC is doing very well. According to a news release (likely authored by LFC) that appeared on

PRnewswire in January,

In a record setting online auction, a 200… acre parcel of real estate in South Florida is being auctioned with a record setting seller's suggested value of [$]80 Million USD. This mixed use property has the potential to attract a wide range of buyers both in the US and internationally, in what is believed to be the highest value online real estate auction of all time.” The auction is being conducted by “LFC Online.”

This Fuentes fella sure does have an interesting relation to big money. He’s like an iron filing in a world of Filthy Rich Magneto-Men.

BUFFALO BILL'S BEANS:

If you go to the

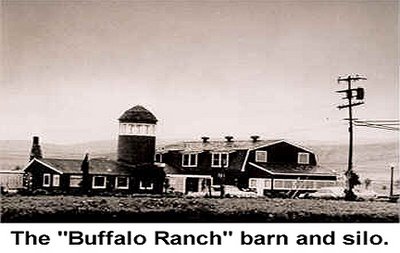

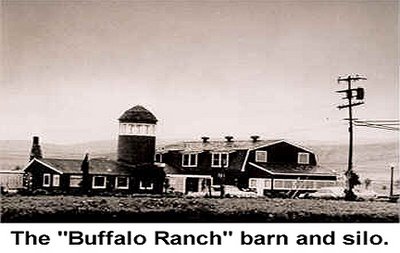

LFC website, you'll find a very odd “history” of the company. Inexplicably, the entire history is devoted to the tale of a "Buffalo Ranch" [

see] in Newport Beach. We’re told that

Until recently, this working ranch, located in the heart of Newport Beach, California, doubled as LFC’s corporate headquarters….

In 1986, after a 25-year absence, LFC’s founder, Bill Lange, reintroduced a herd of American bison, commonly called buffalo, to LFC’s Buffalo Ranch. The new herd included Scotty, our 2000-pound male, along with Wendy, Amanda and Patti. The Buffalo Ranch soon became a standard fixture on the elementary school circuit. After all, not every city has its own buffalo herd!!

Each summer LFC would invite its clients from throughout the United States and around the world to what became known simply as the “Buffalo Ranch Barbecue.” This one-day event became famous for its diverse group of guests. Chinese, Japanese, Mexicans, Canadians, Europeans and Americans would all show up in their best cowboy and cowgirl outfits to share a day of great country western music, good steaks and Bill’s Beans.

I’m not making this up,

honest I'm not. If you take the online tour, you learn lots more about the history of the Buffalo Ranch:

...the Buffalo Ranch was used as a working part of the Irvine Ranch until 1954, when buffalo rancher Gene Clark opened it as a public attraction and imported over 100 head of buffalo to the 115-acre parcel of land….

Occupied in the 1970’s by the late famed architect William Pereira, a self-proclaimed "barn freak," the Buffalo Ranch red clapboard barn and buildings provided a tranquil and relaxed setting for Pereira, who renamed the ranch "Urbanus." From his office atop the silo, Pereira produced plans for UC Irvine and Fashion Island.

--Well, I guess that explains why so much bullshit emanates from UCI. But I digress. This history continues:

From 1986 to 1994, The LFC Group of Companies made the Buffalo Ranch our headquarters…. Employees played volleyball on the back lawn, tended the bison, held western barbeques and enjoyed the rustic setting of Lange Financial Plaza. Newport Beach provided the perfect setting for the bison to roam amid beautiful surroundings. When The Irvine Company announced plans to develop the adjacent property into condominiums and apartments, an outspoken contingent of Orange County residents took it to heart. Attempting to block the proposed development, they started a grass roots organization called "Friends of the Buffalo Ranch." The development ultimately received approval from the planning commission. Part of the barn structure was declared an historic site and was moved to the Orange County Fairgrounds.

The bison herd was donated to the Discovery Museum of Orange County and auctioned (naturally). Becky was donated to the Orange County Fairgrounds and is still visited today by Buffalo Bill [i.e., William Lange] and his family.

BUFFALO BILL'S WILD FRAUD SHOW

BUFFALO BILL'S WILD FRAUD SHOW

I Googled the name “William Lange” with “LFC” and I didn’t find much.

I did, however, find that, in 1997, Lange was sued by the government. Evidently, the Justice Department was convinced that “Buffalo Bill” was committing fraud in a very big way. A year after charges were filed, the matter was settled, and the defendants (including Buffalo Bill) admitted no wrongdoing.

The charges are amazing. You’ve really got to check this out. I tell you, this "fraud" yarn is like an episode of

Knott’s Landing! Picture Buffalo Bill as William Devane and his wife as Donna Mills.

The tale is told on the website for the Federal Deposit Insurance Corporation’s (FDIC) news releases [

News Release]:

FDIC PRESS RELEASE:

SETTLEMENT OF LAWSUIT AGAINST FORMER FDIC AND RTC CONTRACTORS

The suit described in PR-49-97 (7-18-97) [see below] was settled by an agreement between the United States Department of Justice,

William W. Lange, Alisha A. Jensen Lange, Lange Financial Corporation, Asset Clearinghouse, Inc., and Richard H.W. Bennett, executed by all parties on November 13, 1998. That agreement contains a statement that it does not constitute an admission of liability or an admission of the truth, substantial merit or validity of any previously disputed claim or factual assertion.

[The site next presents what appears to be an earlier press release [from 7/18/97?]:

THREE FORMER FDIC AND RTC CONTRACTORS SUED IN MULTI-MILLION DOLLAR FRAUD CASE

FOR IMMEDIATE RELEASE

FDIC Inspector General Gaston L. Gianni, Jr., announced today that the Justice Department filed suit July 15 against three California residents charging them with fraud that resulted in nearly $3.6 million in profits from contracts issued by the FDIC and the former Resolution Trust Corporation (RTC) to auction assets.

This case is the result of an ongoing investigation by the FDIC Office of Inspector General. The defendants named in the lawsuit are:

• William W. Lange of Corona Del Mar

• Alisha A. Jensen Lange (William Lange's wife) of Corona Del Mar, and

• Richard H.W. Bennett of Yorba Linda. Mr. Bennett is a certified public accountant and the brother-in-law of Alisha Lange.

The civil complaint, filed pursuant to the False Claims Act, alleges that the defendants fraudulently acquired contracts and overbilled the two agencies for work performed. The three were allegedly responsible for more than 2,500 false claims submitted to the FDIC and the RTC.

In the scheme outlined in the lawsuit, Ms. Lange owned "on paper" a sham company called LFC Real Estate Clearinghouse, Inc. (LFCREC). The company in fact was created, owned and operated by her husband, William Lange. The Langes improperly certified that LFCREC was woman-owned, enabling the firm to obtain lucrative government contracts. Those contracts, procured from 1992 through 1994, called for the LFCREC to auction property for the FDIC and the RTC that the agencies had acquired from failed financial institutions.

According to the lawsuit, LFCREC fraudulently obtained contracts to perform more than a dozen auctions in California, Texas, Louisiana, Massachusetts, Connecticut and New Jersey. The shell company was paid more than $1 million in commissions, approximately one percent of the assets sold. LFCREC was also reimbursed more than $2.5 million for expenses the firm claimed to have incurred in connection to the auctions.

The civil complaint alleges that LFCREC was a shell company for Lange Financial Corporation, a Newport Beach firm that is one of the largest auctioneers in the country with several subsidiaries. In addition to falsely stating that LFCREC was woman-owned, LFCREC allegedly hired subsidiaries of Lange Financial to perform auction-related work and failed to disclose that the subsidiaries were "related companies." The subsidiaries purportedly overbilled for services, including charging the government $80 per hour for work that cost $24 per hour. Mr. Bennett allegedly prepared and submitted "padded" bills to the FDIC and RTC.

Under federal law, the Langes and Mr. Bennett are potentially liable for damages of up to three times the nearly $3.6 million paid to LFCREC, and up to $10,000 in fines for each of the more than 2,500 alleged false claims. The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) provides an additional $5 million penalty for making false statements designed to influence the RTC and the FDIC.

Like I said, it’s essentially an episode of Knott’s Landing.

And our Tom Fuentes is the Senior VP of Buffalo Bill (Devane) Lange’s LFC.

Why does this make so much sense? I am filled with calm and a profound sense of understanding.

Be likewise.

SEE ALSO

●

William Lange LFC's Blog

●

106 F.3d 391 (Appeal of judgment) Also

here

●

LFC Group of Companies

●

REAL ESTATE COMMISSION See p. 7

●

Quatloos/Investment Fraud Skip to last section: LFC Marketing Group, Inc. v. Loomis (09/19/2000)

●

Auctioneer Is Accused of Scheme to Defraud U.S. (LA Times,

7/17/97)

Courts: William W. Lange, who helped broker deals for O.C. properties, is named in $43.5-million civil suit.

JAMES S. GRANELLI - TIMES STAFF WRITER

William W. Lange, an auctioneer who has worked for tycoon Donald Trump and sold some of Orange County's properties in bankruptcy, was accused in a civil lawsuit of creating a phony female-owned business to win federal contracts.

The suit, filed by the U.S. attorney's office, also accuses Lange, his wife, Alisha, and her brother-in-law, Richard H.W. Bennett, of covering up evidence of the alleged sham company and of overbilling the government as much as triple the going rate.

The recent lawsuit seeks $3.6 million that government agencies paid in commissions and expenses to Alisha Lange and her LFC Real Estate Clearinghouse, which prosecutors called a front for William Lange and his Lange Financial Corp.

With trebling of damages and other penalties sought for false claims, the total amount the government is seeking is $43.5 million.

The lawsuit stems from work Clearinghouse did in the early 1990s for the Resolution Trust Corp. and the Federal Deposit Insurance Corp., agencies that were disposing of assets from, respectively, failed savings and loans and failed banks.

U.S. Atty. Nora M. Manella said[*] that in helping to clean up the S&L debacle of the 1980s, "Mr. Lange masterminded a multifaceted fraud that allowed him to profit illegally from the savings and loan crisis and from programs designed to help women."

John Petrasich, attorney for the Langes, denied that his clients did anything wrong, calling the lawsuit "nonsense." Clearinghouse, he said, "is and was from its inception a wholly owned company of Alisha Lange."

He acknowledged that William Lange was an officer in her company, but that fact didn't make it ineligible for special consideration under federal rules granting preferences to minority- and female-owned businesses in contracts awarded by the RTC and the FDIC.

The agencies regularly used outside contractors to manage, market and sell real estate, securities and other assets held by failed financial institutions.

Clearinghouse handled more than a dozen auctions nationwide of primarily residential real estate for the two agencies in the early 1990s, according to both sides.

By then, Lange Financial, founded in 1986, was becoming a major auctioneer nationwide by helping financial institutions, real estate developers and others market and sell properties that weren't otherwise moving.

*In March of ’99, in court, U.S. Court Judge Manella opined that the SOCCCD's action against me/Dissent was “Orwellian” (1st Amendment Battles).

Today the seven members of the French faculty at SUNY--Albany (all tenured) were informed that by presidential decision, ostensibly for budgetary reasons, the French program has been "deactivated" at all levels (BA, MA, PhD), as have BA programs in Russian and Italian. The only foreign language program unaffected is Spanish. The primary criterion used in making the decision was undergrad majors-to-faculty ratio. We were told that tenured faculty in French, Russian, and Italian will be kept on long enough for our students to finish their degrees--meaning three years at the outside. Senoir faculty are being encouraged to take early retirement. The rest of us are being urged to "pursue our careers elsewhere," as our Provost put it.